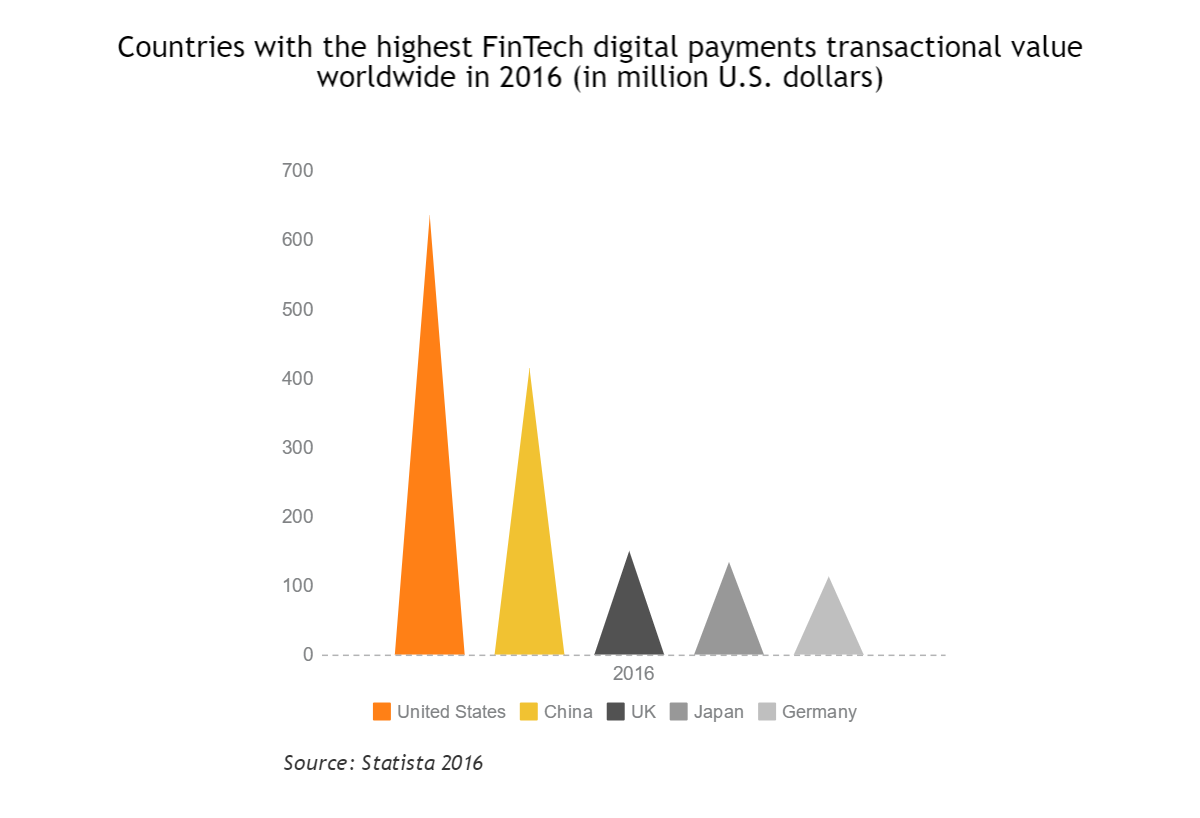

Hundreds of fintech app development companies have received immense investments and earned their decent place in the sun in the recent years. They offer their users new quality of financial services, making their transactions faster, safer, easier and more cost-efficient. The United States, China, the UK, Japan and Germany are the countries that have witnessed the steepest growth.

Legislative bodies in these regions found themselves unprepared for such rapid changes. Trying to catch up with the industry, they issue new norms and set up new regulatory institutions. In this article, we’ll try to establish how fintech outsourcing providers adapt to these changes and satisfy the industry standards. However, let’s first determine the major motivations driving fintech companies to cooperate with IT outsourcing companies.

Why fintech companies outsource

Fintech companies run their business in a very dynamic market. The industry is developing at a breakneck speed, new players enter the market, the technologies change, the niche changes, governments introduce new laws etc.

A typical fintech startup is growing fast, thus technical issues keep piling up. As a result, the company might accumulate the technical debt. Oftentimes, startups don’t have enough resources to keep up the highest quality of code, analyze it, rewrite it if necessary. They’re busy taking care of business issues, handling the finances, clients requests etc.

In some of the worst-case scenarios, the company might lose the licence or their system won’t be able to process the requests of the growing number of users. When such problems arise, they start thinking about how to rebuild the processes and fix all these issues. Moreover, they need to think about scaling their product for new markets to get more users. They also realize that it will be impossible to get the next round of investments when the technical audit identifies all these technical flaws.

So the company needs to take technical consultants and engineers to identify the problem and establish how much time it will take to solve it. As a rule, doing this in Europe or in the US is expensive and time-consuming because firstly, these consultants cost a lot, secondly, it’s extremely difficult to find them, and lastly, they are all busy with other projects.

Eventually, fintech startups address the outsourcing provider which is fast, flexible, and inexpensive. They know that solving these problems in London will be pricey, to put it mildly. To mitigate the risks, they hire an outsourcing company that has the resources to deliver the solution fast while maintaining the high quality of software.

How outsourcing companies satisfy the needs of fintech industry

Demonstrate high level of adaptability

Timing really matters in fintech. This is one of the main reasons for outsourcing software development and providers are well aware of it. It’s very difficult for fintech startups in Western Europe to be flexible in hiring staff and letting people go. An outsourcing company can change some business and software development processes faster and more easily. And the best providers try to think in advance and envision issues that might arise. Whether you need to comply with the new requirements in technical documentation or the recent legislation on data protection, an outsourcing company has the flexibility to do it faster.

Engage business analysts, lawyers, fintech industry specialists

IT companies that work with fintech clients rarely limit their expertise with software development services. On this market, it’s very important to understand how this industry works, what are the most recent legal requirements and latest technological trends.

A good outsourcing provider hires business analysts and lawyers who make sure the developers deliver the product that meets all the requirements. Also, they give an important input to the development team which can take it into account when building the architecture, thinking about the security, scalability etc. So the company that has capacities to help not only with development but also ensure that the product complies with major regulations and industry standards is a great advantage.

Hire information security specialists

Security is apparently the most important thing in fintech business. Any IT services provider working with fintech companies knows that it’s critical to ensure the security of software they’re developing. There are many fintech regulations concerning consumer protection, data breaches, privacy etc. Hiring information security specialists who could take care of all these issues is difficult and costly. These specialists are hard to come by and their services are some of the most expensive on IT labour market. Whereas, in outsourcing markets, there is wider availability of talent and major providers can afford having these professionals among their staff.

Maintain high standards of technical documentation

Another important standard software developers need to maintain when they cooperate with fintech companies is the quality of technical documentation. In this niche, there is just no such thing as self-documented code. When the users’ money are at stake this aspect can’t be taken lightly. So the outsourcing provider has to make sure that managers and engineers that work on fintech projects don’t neglect this requirement.

Open an office in Europe

Fintech companies might be bound by industry regulations that make outsourcing to some countries impossible. For instance, they might be allowed to work only with the EU members or the countries that have certain legal instruments regulating the activity of the provider. Yet, the companies that want to attract fintech business manage to come up with solutions even to this problem. It’s a common practice among outsourcing companies to open offices in the EU and relocate some of their engineers in order to comply with the requirements of the project.

To conclude, the remarkable development of fintech industry has created incessant demand for IT specialists. Hiring engineers in places where talent pools are not so low is a great way to deal with this challenge. Many fintech companies cooperate with IT outsourcing providers to get access to skilled engineers, obtain more flexibility and, more importantly, cut development costs. Suffice to say that many global fintech brands such as Currency Cloud, Baxter FX, Lebara Money, Misys, Yapital, Skrill have all taken advantage of outsourcing development to Eastern Europe.

Legislative bodies in the EU and the US are trying to keep up with this growth introducing many new legal norms to regulate the industry. All these changes influence fintech businesses, so the ability to adapt fast is critical for the players on this market. Development outsourcing providers are not lagging behind. They go beyond their mostly technical area of expertise to attract fintech clients. Thus, this cooperation is beneficial for both sides despite all the subtle nuances and high standards of fintech industry.