Digital transformation is not a buzzword anymore, it is a matter of survival. Smart technological start-ups disrupt established competitors and the whole industries. If your products, services, and experiences are not digitally enhanced, there is a big chance your business model will become obsolete by 2020. We elaborate on this topic in the following white paper.

Disruptive technologies affect global economy in so many ways:

- Create new business opportunities.

- Generate new funding channels.

- Speed up business innovation.

- Shift customer expectations.

- Increase the demand for digital employees, and more.

By 2020, digital will be the key revenue driver for 50% of the Global 2000 companies. Keep in mind, the majority of the world’s biggest publicly traded corporations operate in the mature industries like Retail, FMCG, Finance, Insurance, Automotive, Oil & Gas. This means virtually the whole world economy is being disrupted. Decision makers across the world agree disruption is imminent even for industries where penetration of digital technologies has been historically very low.

Disruptions force businesses to deal with the changing environment. By 2018, over 70% of the world’s largest corporations will establish dedicated digital transformation teams. At the same time, various studies indicate there is still a huge gap between the understanding of the need for change and kicking off the actual digital transformation.

This statistics has one important implication: even if you are behind with digital, there is still time to close the gap. With effective digital transformation strategy in place, any company can catch up with the leaders in a relatively short timeframe. This is especially true for industries where digital penetration is relatively low, e.g. Insurance and Retail Banking.

The Rise of FinTech & Digital Transformation in Banking

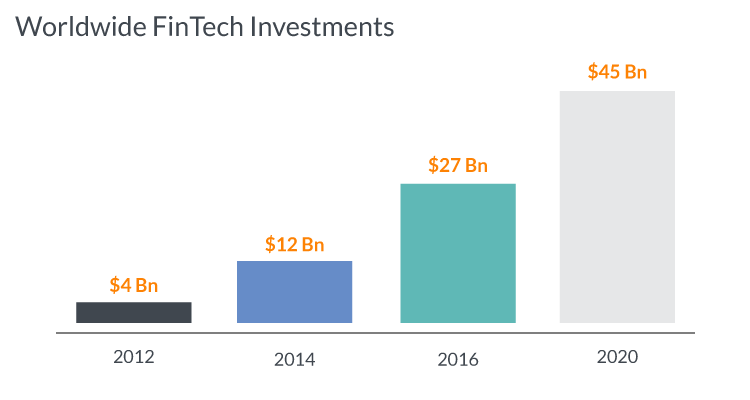

Banking is a great example of how an industry can be disrupted by new technological startups and how established players can try to retaliate. The rise of the FinTech and its exponential growth over the last five years is remarkable. Disruptive technologies, increasingly extensive use of smartphones, and global financial crisis all played their role in the emergence of FinTech. In a blink of an eye, established retail banks saw industry flooded with technological startups that offered new contemporary ways of doing banking.

We have helped CurrencyCloud and the a leading UK peer-to-peer compny with their transformations. Both British companies seek technological excellence and delegate parts of their research and development to outsourcing companies. They leverage technologically developed communities and set strategic partnerships with third-party solution providers and financial software development firms in Eastern Europe. These enterprises built a transparent and efficient IT infrastructure around customers and user expectations towards technology. Additionally, they automate customer interactions and achieve operational efficiency with deep integration of customer facing and back-office solutions.

Big multinational banks quickly realized that extensive use of technology by FinTech companies is not just a fancy way to attract younger customers. Digitally native financial companies enjoy higher profit margins compared to their rivals that follow traditional non-digital paradigms. Banks acknowledged the threats coming from technological disruptions and launched remarkable digital transformation of the banking industry. Some were able to match or even overtake FinTech companies in terms of their digital capabilities. The famous examples are Capital One, Barclays, and Caixa.

These success stories are a good benchmark for companies that operate in another mature financial sector – Insurance. The penetration of digital technologies in this industry is still remarkably low. This means established companies can play proactive and shield themselves from new tech entrants by becoming digital natives themselves. But they have to act fast.

InsurTech and Digital Transformation in Insurance

Much like retail banking, insurance is facing technological disruption. Customers including corporate clients and brokers are used to great digital experiences, be it online shopping with Amazon, taxi rides with Uber, or retail banking with Barclays. Quite logically, they expect the same service quality from insurers. But it’s not there yet. Keep in mind that global insurance market generates $4 trillion in revenue, and you can be certain there will be a whole army of tech companies racing in to take a chunk of that lucrative pie.

In most countries, Insurance is a highly regulated industry where companies are obliged to comply with the strict financial requirements. Another entrance barrier in insurance was complex a pricing system that required a whole team of actuaries to assess risks and project future losses. Now, technology eliminates these entry barriers with Data Science and Internet of Things (IoT).

Machine learning algorithms allow faster and more accurate risk estimations, while connected cars and devices provide insurers with precise data about risk factors for particular policyholders. Armed with these notable technological tools tech startups already challenge leaders of the insurance industry. Make no mistake, CEOs of the largest insurance companies are well aware of the challenges that lie ahead:

Three-quarters of the industry’s top executives feel digital disruption is inevitable.

Insurance companies are ready to follow the footsteps of the banks. Much like banks, they need to transform into digital natives:

- Establish dedicated digital transformation teams.

- Engage in strategic partnerships with tech companies.

- Outsource development to experienced third-party vendors.

All these steps will help to smooth the transition and greatly speed up transformational efforts. There are two large areas where insurance companies can improve their digital capabilities: front-office and back-office operations.

Front-Office Digital Transformation

Insurance companies are stuck with the old sales channels and service techniques while user expectations shift towards digital. There is a strong need to redefine customer interactions and decision journeys with digital technologies in mind. Existing and prospect policyholders expect an enhanced digital experience:

- Personalized web and mobile sales channels.

- Peer-to-peer insurance models.

- Usage- and behavior-based pricing.

- Self-directed service, zero or few human interactions.

- 24/7 accessibility from any device.

InsurTech companies like Lemonade and Teambrella use peer-to-peer models that eliminate most of the human interactions. They also fulfill other customer expectations like fast, convenient, and reliable service on any device, 24/7. These startups were able to raise substantial funding meaning their models are valued highly by investors and financial institutions. More information on Lemonade and Teambrella and their business models in this blog post.

Established insurance companies, too, need to put customer at the center of their operations. Business and private policyholders expect digitally enhanced services. This means insurers have to shift from traditional sales channels to web- and mobile applications, from physical help centers to AI chatbots, from fixed to personalized pricing models.

Outsourcing digital transformation efforts is a great way to start. For instance, creating a compelling and effective mobile application can be a hard task for an IT department of an insurance company. Collaborating with an experienced vendor eliminates these constraints. For instance, third-party solutions providers in Eastern Europe help businesses build end-to-end scalable enterprise solutions with great UX and usability.

Back-Office Digital Transformation

Insurance companies can leverage digital technologies to improve their back-office operations. Some of the examples are Big Data, Data Science, and Machine Learning. These tools proved to be valuable assets in other industries cutting labor cost, improving scalability and predictability. Here are a few examples of how digital technology can help insurance companies improve their back-office efficiency:

- Standardization & better IT infrastructure. More often than not, insurance companies operate in many different countries. Just like telecom companies, they can benefit from creating a unified catalog of the ways to deliver services, shared real-time knowledge databases, and more.

- Process automation can eliminate many administrative tasks. This will cut labor costs and allow employees to focus on their key value-generating activities.

- Data mining. Machine learning, neural networks, and AI algorithms allow more sophisticated customer segregation, targeted discounts and promotions for low-risk customers. Ultimately, data mining aims at growing customer base and increasing profitability.

- Risk assessment & fraud detection. The same sophisticated tools like AI and Machine Learning can be used for precise and insightful risk management and to recognize fraudulent behavior.

Retail banks and insurance companies still have time to design and implement digital transformation initiatives, but time is not on their side. Old business models simply won’t work in the near future. Disruptive technologies reshape even these traditionally conservative industries. With FinTech and InsurTech stepping on their heels, established financial companies can’t afford to sit back and wait. 2017 is the right time to make digital technologies an integral part of their corporate culture.

Here is a ppt presentation with some of the key points of the article: