The fintech boom has brought to life numerous projects focused on improving the quality of financial services. According to the recent Deloitte report, investment in the fintech industry is expected to reach $52.9B in 2022. With more industry-disrupting projects looming on the horizon, the demand for financial technology providers is ever-increasing. The development of such projects is outsourced to ensure cost optimization. Another pivotal reason is to deal with a persistent fintech talent shortage of 200,000+ specialists, according to the US Bureau of Labor Statistics.

With 1,000+ fintech outsourcing providers operating in Europe, finding a suitable vendor is a pivotal option. As of now, Ukraine, Poland, Romania, and Bulgaria are in the lead in concentrating on skilled tech specialists that can deliver fintech projects. Our team has made a selection of top financial technology providers operating in these countries with a vast experience in fintech development.

Selection methodology

With hundreds of fintech outsourcing providers on the market, making the final decision can be complicated. When creating this list, we referred to Clutch as a reliable source of financial services technology providers. Our crucial selection criteria for this list were:

- 250+ skilled tech professionals. Midsize-to-large vendors provide wider access to the tech specialist pool;

- High (4.7+) Clutch review scores that prove the provider’s reliability and reputation in the fintech niche;

- 10+ years of experience in delivering custom financial services solutions;

- A solid portfolio of fintech projects for banks and financial institutions, coupled with clients’ references and testimonials.

We focused on compiling a list of financial technology providers with a well-rounded portfolio, trusted reputation, and decent client testimonials. Now, let’s look at some of the best European fintech service providers.

Fintech outsourcing companies in Ukraine

Widely known for its engineering talent, Ukraine is one of the top development outsourcing centers in Eastern Europe. With 300+ outsourcing vendors providing financial services, the country has an untapped potential for streamlining your development process. Holding the 42nd place in Kearney Global Services Location Index in 2021, the country’s IT sector grew by 13% in 2021 alone. With nearly 300,000 Information and Communications Technology (ICT) specialists, the country is a decent outsourcing destination for your fintech project.

1. N-iX

N-iX is a European custom software development provider with 20+ years of experience in delivering projects for global clients. With a solid team of 2,000+ tech specialists, the company’s expertise ranges from Big Data Engineering, Data Analytics, Data Science, ML&AI, BI, and DevOps, to name a few. N-iX has also been featured in reputable industry ratings, such as Forbes, CRN, IAOP, Software 500, GSA UK, and more.

In financial processing solution development, N-iX delivers direct integration, multi-currency processing solutions, reconciliation, contactless payments, payment-gateway development, and mortgage automation. As for fintech-specialized services, N-iX helps global fintech companies develop innovative technology solutions. These solutions include digital banking, online trading, integration and optimization, money transaction platforms engineering, maintenance, and modernization of existing infrastructure.

N-iX fintech portfolio

Regarding the fintech portfolio, N-iX has successfully delivered projects for global clients, such as cleverbridge, Currencycloud, and a leading UK bank for small businesses.

- cleverbridge provides full-fledged e-commerce and subscription management solutions for monetizing digital goods, online services, and SaaS across various industries. The company’s experts expanded the service offering with effective data analytics reporting, allowing the company to gain valuable insights into clients’ performance.

Read more: Driving growth in e-commerce with a comprehensive data analytics solution

- Currencycloud is a global B2B platform delivering cross-border payments, allowing customers to manage the fund flow through the multi-currency wallet functionality. The N-iX team improved the scalability and fastened development cycles using the microservice-based approach to architecture design. As a result of this cooperation, N-iX also delivered payment optimization for different regions and automated the client’s compliance check system.

Read more: Global payments made easy with an efficient and secure cloud-based payments platform

- Our client is a UK-based digital challenger bank for small businesses. The company offers fast, smart, and simple banking services for entrepreneurs and independent businesses. The client needed to redesign and rebuild a mobile banking application. More importantly, the client requested the implementation of Open Banking, a mandatory requirement for UK financial institutions. With compliance and security in mind, the N-iX team built a custom solution from scratch, completed Open Banking integration, and implemented robust in-app security features.

Read more: Neobank transformation with compliance and security in mind

2. DataArt

DataArt is a global software engineering firm with solid experience working with clients of financial services and capital markets. With about 5,000 experts across Europe and the US and the headquarters in New York, USA, the company has been delivering financial technology solutions since 1997. This vendor has an extensive experience in fintech development, with delivered projects for Misys, Bematech, Credorax, CIFC, and other industry players.

3. Ciklum

Ciklum has a wide domain specialization of delivering software development, quality assurance, IoT, product development, and engineering consulting services. Headquartered in London, United Kingdom, the company has dozens of delivery offices across Europe. With a team of 4,000+ like-minded experts globally, they deliver their services in the domains of healthcare, fintech, travel, security, and entertainment. Regarding the delivered projects, the company’s fintech portfolio includes projects for Paycash, Yapital, Leverate, and Seeking Alpha.

Financial technology providers in Poland

Poland, with a talent pool of nearly 500,000 ICT specialists, has hundreds of financial technology providers. The country has nearly 1,000 IT companies, making it a vibrant market for outsourcing financial services. Reaching the 14th position in Kearney Global Services Location Index in 2021, Poland is one of the go-to places to search for suitable fintech outsourcing providers.

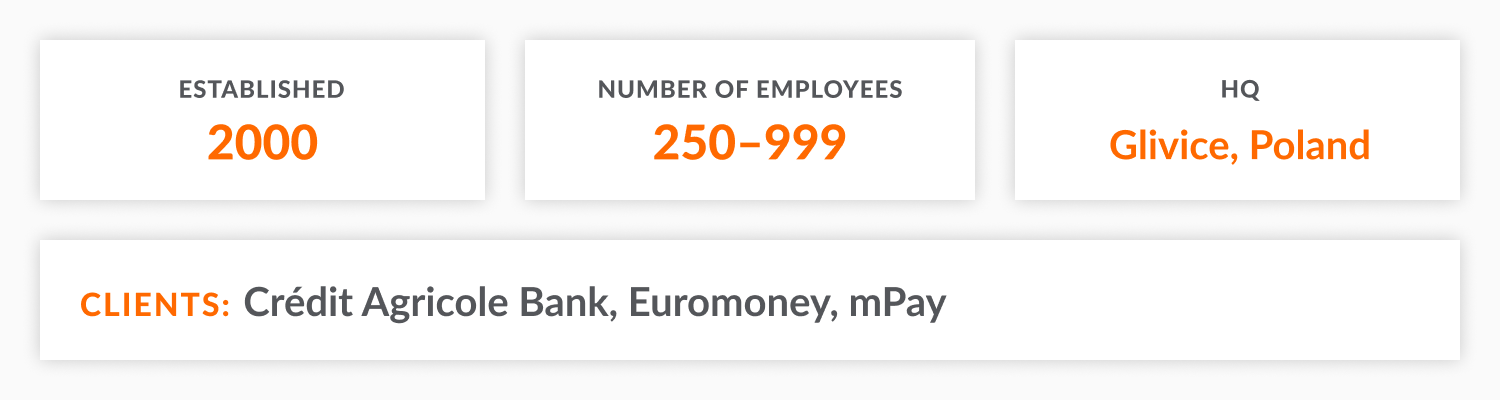

4. Future Processing

Founded in 2000, this is a Polish powerhouse for custom software development. With a solid team of 250+ employees, the company delivers excellence in development, tech consulting, digital transformation, and more. The company has delivered nearly 600 projects for 200 global clients, with notable fintech enterprises, such as Euromoney and mPay.

5. Software Mind

This is another representative of the Polish outsourcing vendor with 20+ years of experience operating in the global markets. With 11 R&D centers worldwide and 1,000+ delivered projects, the tech team behind the scenes knows how to deliver. Concerning fintech, the company provides tailor-made financial software solutions, with 300+ global projects in its portfolio. Except for the full-fledged offering, they deliver digital transformation, cloud, and open banking integration solutions. Its key clients include Deposit Solutions, CallCredit, and CitiBank.

Financial technology providers in Romania

Romania is another popular development outsourcing destination, with 190,000+ ICT professionals and 300+ development outsourcing companies. What’s more, Romania hosts 40+ fintech outsourcing providers. For this list, we’ve selected two established financial services technology providers with a trusted reputation and a well-rounded portfolio of fintech projects.

6. Zitec

The company is widely known in Romania and abroad for its wide range of development services, including cloud, quality assurance, audit & consulting, and fintech. The vendor has been operating since 2003 and has successfully delivered 650+ projects for global clients. In the niche of financial services development, the company offers digital banking, risk management, RPA, and blockchain solutions. The company’s notable clients are Card Avantaj, PayU, and PayPoint.

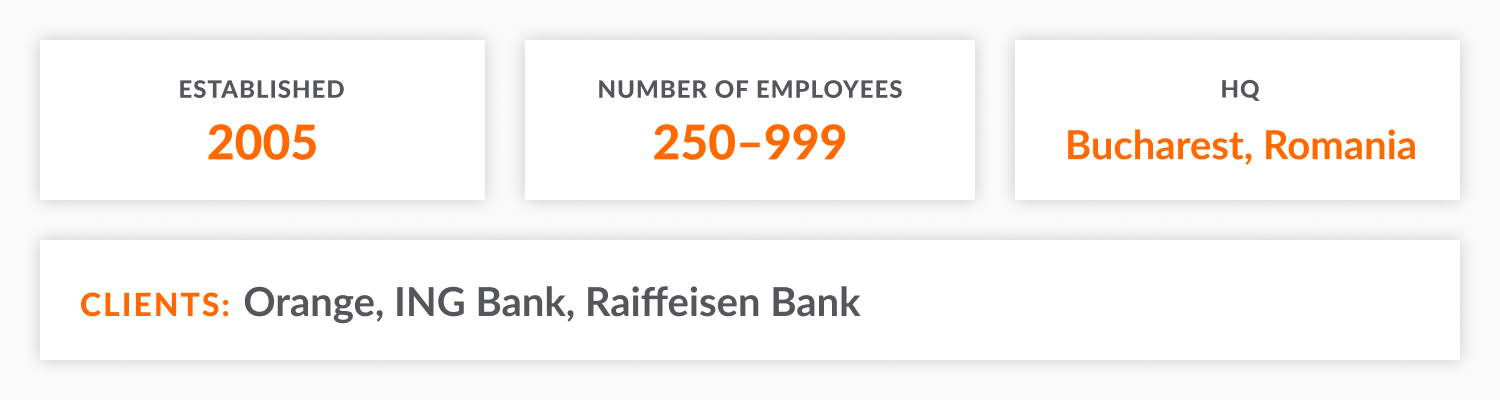

7. Tremend Software Consulting

Founded in 2005, the company has expanded its services beyond Romania, with offices in the UK, the US, Luxembourg, and Belgium. This vendor delivered 800+ projects for leading companies in the banking and financial services sectors. The tech team comprises 250+ specialists, with a vast majority of them experienced in finance and ecommerce. Their key clients in the fintech industry include Raiffeisen Bank, ING Bank, and Orange.

Fintech service providers in Bulgaria

Although the list of outsourcing providers is a bit smaller in Bulgaria, it’s a host to 70+ fintech outsourcing vendors. Ranked 17th in Kearney Global Services Location Index in 2021, Bulgaria is one of the most suitable places for outsourcing a fintech project. With nearly 30,000 specialists involved in IT services, finding the right provider wouldn’t be a huge issue. For this country, we’ve shortlisted two leading Bulgarian companies with an impressive fintech portfolio.

8. Scalefocus

Scalefocus, headquartered in Sofia, Bulgaria, has 10 years of experience in providing tailored software solutions to global clients. The company provides end-to-end IT consultancy and development services with delivery centers in Bulgaria, North Macedonia, and Turkey. Scalefocus has a portfolio of 500+ completed projects for 300+ clients, including established industry leaders. In the fintech industry, its most notable partnerships include ING, UP, and Santander.

9. Stanga1

Operating since 1999, this is a Sofia-based software development company with 300+ tech specialists. In the list of its services, one can find full-cycle product development, dedicated teams, and managed projects for fintech, cybersecurity, and e-commerce industries. Over the last 20+ years of operations, the company kicked off and delivered fintech and ecommerce projects for Emirates, Bitcoin Miners, and Tekra.

Wrap-up

When choosing the trusted vendor from the list of financial services technology providers, pay attention to the client reviews and the number of global projects delivered. Regardless of your project’s size, complexity, or technical requirements, the fintech development vendor will tackle the project’s challenges. If you’re still hesitant about what company to choose from the list, the following points might help you make up your mind.

Why should you choose N-iX for your next fintech project?

- N-iX is a reliable global vendor with 20+ years of experience and 2,000+ tech professionals ready to support and consult your financial solutions development process, from Product discovery to post-deployment maintenance;

- The company has a proven record of working with payment integration, multi-currency processing solutions, fraud prevention, and other financial processing solutions;

- N-iX has 20+ successful partnerships with world-known fintech enterprises, such as Currencycloud, cleverbridge, and Seeking Alpha, as well as delivered projects for Fortune 500 companies;

- The company has a reputation as a trusted service provider, proven by numerous industry awards, including GSA, IAOP, Software 500, Clutch 500, and others;

- N-iX is compliant with international regulations, including ISO 27001:2013, GDPR, ISO 9001:2015, and PCI DSS.